Exclusive access to educational articles on global financial markets + free newsletter

Learn more about global financial markets at a time when the financial world is changing inexorably

How to easily understand complex topics such as monetary and interest rate policy and the differences between the real economy and the financial markets

Welcome to SSFX Education, your guide to the complex world of micro- and macroeconomics.

Our focus is on microeconomics, in particular the fascinating banking sector. Experience with us how banks not only act as financial intermediaries, but are also closely linked to central banks. We shed light on how monetary policy decisions, such as the setting of key interest rates, have a direct impact on the day-to-day operations of banks and ultimately on the economy as a whole.

But we don't stop at the microeconomic level. Macroeconomics is an equally central topic at SSFX Education. Learn more about interest rate developments in different countries and their impact on the global economic structure. Together we look at how financial markets and the real economy interact, influence each other and sometimes drift apart.

An important note: SSFX Education provides purely educational material. Our articles are in-depth, well-founded and free of speculative investment advice. Our mission is to promote education and give you the tools to better understand the economy.

Immerse yourself in the fascinating topics of business with us and broaden your horizons at SSFX Education.

Blog

FAQ

What other participants asked themselves before they became active

The real economy refers to the sector of the economy that includes the production of goods and services. This includes all economic activities in which actual goods are produced, sold and purchased - from food and machinery to services such as hairdressing or consulting.

In contrast, the financial economy or financial sector is concerned with the management of money and other financial assets. While the real economy produces and sells physical and tangible products and services, the financial sector is concerned with generating profit from the ownership or trading of financial instruments (such as shares, bonds and derivatives).

Put simply, the real economy is concerned with the actual production and consumption of goods and services, while the financial economy focuses on the capital and money markets. Both sectors are closely linked, but can also have different cycles and dynamics.

Macroeconomics and microeconomics are two main branches of economics that deal with different aspects of economic activity. Here are the main differences:

*Microeconomics:*

1 *Focus:* Deals with the behavior of individual economic units such as households, companies and individuals.

2 *Topics:* Key topics include supply and demand, price setting, factor markets (e.g. labor market), individual consumer decisions and the production of individual companies.

3 *Aim:* The aim is to understand how prices are formed, how resources are allocated in the economy and how individuals and firms make decisions.

4 *Applications:* Market analysis, business management, pricing strategies, competition analysis.

*Macroeconomics:*

1 *Focus:* Looks at the economy as a whole and examines macroeconomic variables.

2 *Topics:* The main topics include national income, unemployment, inflation, economic growth, monetary policy and fiscal policy.

3 *Objective:* The aim is to understand and influence the overall growth, stability and economic health of an economy or region.

4 *Applications:* Economic policy, monetary policy of central banks, international economic relations.

A simple example to illustrate this: while microeconomics might examine why a particular person decides to buy a car instead of a bicycle (individual decision), macroeconomics would rather examine questions about the total car production of a country or the reasons for unemployment in a particular region (macroeconomic aspects).

Although they have different focuses, microeconomics and macroeconomics are closely linked, and findings from one area can often be used to gain information in the other.

Of course, in relation to what was previously discussed:

In macroeconomics, a recession refers to a significant decline in economic activity in a country over a certain period of time, usually two consecutive quarters. It is characterized by a decline in gross domestic product (GDP), job losses, a decline in corporate investment and a reduction in household consumption.

A recession has a direct impact on the real economy. For example, companies manufacture fewer products or offer fewer services as demand falls. This can lead to redundancies, which in turn further curbs consumption as fewer people have income. Such a cycle can be self-reinforcing and drive the economy further into recession.

The financial sector is also affected. Investors could sell shares in anticipation of falling profits, leading to a fall in share prices. Companies may find it difficult to raise funds as banks become more cautious when granting loans.

It is important to emphasize that recessions are usually cyclical in nature and are a natural part of economic dynamics. They can be triggered by a variety of factors, including external shocks, political decisions or financial bubbles bursting. Central banks and governments can take measures to mitigate the effects of a recession and support the recovery.

A global economic crisis is an extreme and prolonged downturn in global economic activity that is much more severe and widespread than an ordinary recession. While a recession can usually be limited to a single country or group of countries, a global economic crisis affects many, if not all, major economies simultaneously.

In connection with the real economy and the financial sector:

*Real economy:* In the event of a global economic crisis, the real economy suffers serious damage. International trade can fall drastically as demand for exports decreases in many countries. Companies may cut back or stop production altogether, leading to massive redundancies and a sharp rise in unemployment. Lower incomes and general economic uncertainty lead to a drastic decline in consumption and investment.

*The global financial markets can be destabilized by a number of factors, including bank failures, massive capital flight and declining confidence in financial institutions. This can lead to a collapse in lending, further depressing the real economy. As investors become risk averse, share prices fall worldwide and there may be a massive devaluation of assets.

A historical example of a global economic crisis is the Great Depression of the 1930s, which began after the stock market crash of 1929 and had serious economic and social consequences worldwide. The financial crisis of 2007-2008 can also be seen as a form of global economic crisis, as it had a serious impact on many major economies and led to a global recession.

Such crises often require coordinated measures at international level, as national solutions alone are often not sufficient to deal with the global impact.

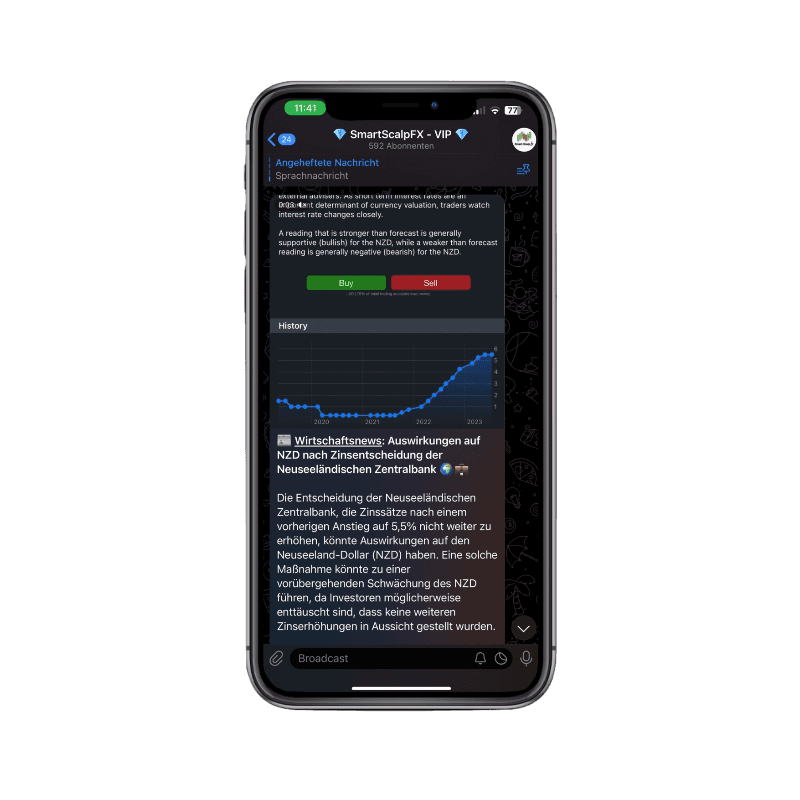

No, the articles are completely free of charge, while access to our VIP group is only free under certain circumstances. Contact us for more information on Telegram.